⭐EXPLANATIONS⭐

▫What is Rabbit Finance▫

Rabbit Finance is a Binance Smart Chain (BSC) Protocol based on the Leveraged Production Protocol and published by Rabbit Finance Lab. It supports users who participate in liquidity farming through excessive borrowing and leverage to earn more income.

When users do not have sufficient funds but want to participate in DeFi's liquidity farm, Rabbit Finance can provide up to 10 times leverage to help users get maximum revenue per unit of time, and at the same time provide a pool of loans for users. who prefer stable returns. to make a profit.

▫Rabbit Financial Features▫

Rabbit Finance is a leveraged yield farming protocol built on the BSC platform that makes it fast, secure and affordable. With the leveraged yield farming feature provided by Rabbit Finance, it allows users to achieve revenue per unit of time when their funds are insufficient and at the same time provides a loan facility for those who want a stable return. In this way, it enables global users to be able to maximize their profits easily and affordably.

▫Following are Rabbit Finance's features▫

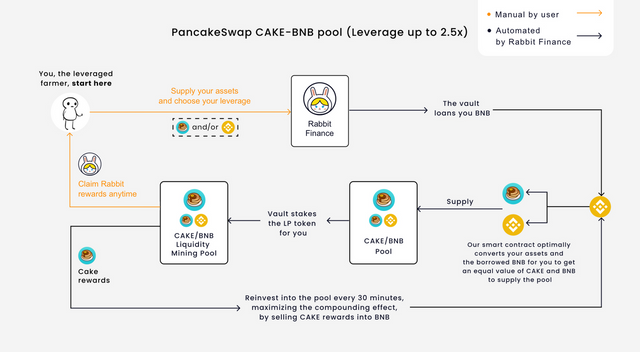

Flexible deposit options: Rabbit Finance designs the vault optimally converts user-stored assets and borrowed BNB or BUSD. So that users don't need to do the conversion themselves.

Auto-betting: The Rabbit Finance mechanism allows betting of LP tokens for users on selected platforms (PancakeSwap, etc.) automatically. So that users can get rewards as soon as possible.

Continuous compounding: Bounty hunters have the role of monitoring the number of gifts earned in each batch and helping farmers to reinvest them.

Claim RABBIT rewards anytime: Rabbit Finance allows users to claim their bonus rewards at any time.

▫How to participate▫

There are four different ways to participate in Rabbit Finances as us:

Lenders: Rabbit Finance allows you to earn income from your core assets by storing them in our vaults. These assets will then be offered to yield farmers to strengthen their position.

Farmer: As a farmer, you can get higher returns by opening a leveraged position with Rabbit Finance. Of course, this comes with a bigger risk: liquidation, variable losses, etc.

Liquidator: Monitoring pond for underwater position and liquidation.

▫In the example below, we show how each participant works together in our ecosystem▫

Cora, the lender keeps his BNB in our vault; the assets become available for borrowing by yield farmers; it's attractive to provide that liquidity.

Dunn, the yield producer wants to open a leveraged yield farm position in the BTC / BNB pair; he borrowed BNB from the vault and benefited from the agricultural produce which produced more.

Rabbit Finance smart contracts handle all the behind-the-scenes mechanisms, optimally transfer assets at the right ratio, provide liquidity to pools and stake LP for Pancake Rewards.

▫Strength and vision▫

Rabbit Finance fully leverages and adopts project benefits in the market, using agricultural products that produce more with the benefits of Alpaca Finance and Badger Finance, creatively incorporating an algorithmic stable currency mechanism to increase the RABBIT token. Across the economic ecology of Rabbit Finance, the RABBIT token, complemented by several application scenarios, represents not only the governance rights and interests of the leveraged farming protocol, but also the shareholder rights and interests of the tokens from the cage. coin algorithm from RUSD. Whenever the RUSD experiences inflation, members who pledge R tokens to the board will distribute additional RUSD as a dividend to share the benefits of green growth.

{Strategies}

Rabbit Finance deploys strategies that work to achieve the highest possible yields for our farmers. We also want to make sure our users have the best experience when interacting with our platform. That’s why we’ve simplified the leveraged farming process by automating many things behind the scenes.

{some of our key features for enhancing usability}

Flexible deposit options: our vault optimally converts your deposited assets and the borrowed BNB or BUSD to get an equal value-split to supply the farming liquidity pool. So for example, for the CAKE/BNB pool, you can deposit any amount of CAKE and/or BNB to start farming without having to do the conversions yourself.

Automatic staking: our code stakes the LP tokens for you on the chosen platform(PancakeSwap, etc. ) automatically, so you can start earning rewards right away.

Continuous compounding: the bounty hunter monitors the amount of rewards accrued in each pool and helps all farmers reinvest it. Our smart contract can sell your rewards(CAKE, etc.), converts them into the LP tokens for the pool you are farming, and compounds them onto your farming principal so you can maximize your APY.

Claim RABBIT rewards anytime: by opening a leveraged yield farming position, you’ll earn bonus rewards that you can claim anytime on the stake page.

As predecessors of this area like Link, COMP, and BAL are fighting alone, Rabbit Finance, a latecomer, has started to propel resource integration to be the one for all of Defi.

Defi ecology, on the Rabbit Finance, ambitiously included modules like lever gun pool + arithmetic stablecoin, NFT+ arithmetic stablecoin. For Rabbit Finance, they hope to build the Defi ecology through the easy to more advanced and Interlocking combination of functions.

it makes it possible for users to experience the various context of the use of DeFi in a one-stop way, as well as yielding rich returns.

◾The feature and value of Rabbit Finance◾

- Cora

the lender deposits his BNB into our deposit vault; his asset becomes available for a yield farmer to borrow; he earns interest for providing this liquidity. - Dunn

the yield farmer wants to open a leveraged yield farming position on the BTC/BNB pair; he borrows BNB from the vault and enjoys higher yield farming rewards. - Rabbit

Finance’s smart contract takes care of all the mechanics behind the scenes optimally switching assets to the right ratio, providing liquidity to the pool, and staking LP for Pancake Rewards - Gary

the liquidator monitors the health of each leveraged position, and when it goes beyond designated parameters, she helps liquidate the position, making sure lenders such as do not lose their capital. For this service, she takes a 5% reward from the liquidated position. - James

the bounty hunter monitors the amount of rewards accrued in each pool and helps reinvest it back, compounding returns for all farmers. For this service, he takes 0.4% of the reward pool as a reward. 30% as buyback fund, which will be used for RABBIT’ buyback and deflation. The remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns.

Besides, when the bounty hunter pitches on the pool and executes the reinvestment, 30% of the bounty of the pool is used as buyback funds to promote the value of the token.

Why does reinvestment raise the value of the token? This can be explained by the supply and demand relationship in economics. When the demand exceeding the supply, the value of the asset is bound to raise. According to the deflation mechanism of Rabbit Finance, the 30% of reinvestment earnings is used to repurchase fund to realize the continuous deflation of the token. In the author’ perspective, the deflation mechanism of Rabbit will become the vital factor for realizing the price of token. Continuous buyback and dispose make it possible for the volume of token supply to decline on a limited scale. These will drive the token to be increasingly precious. When Rabbit achieves its implementation, the price of the token is expected to rise correspondingly.

The 30% of the bounty of the pool is used as buyback funds to promote the value of the token. For this service, 0.4% of the bounty pool is directly given to the bounty hunter as a reward, the remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns. The huge power gifted by repeated investment makes it possible for investors to make more profits.

◾You can view more detailed information about this project ◾

- WEB SITE: http://rabbitfinance.io/

- TWITTER: https://twitter.com/FinanceRabbit

- TELEGRAM GROUP: https://t.me/RabbitFinanceEN

- GITHUB: https://github.com/RabbitFinanceProtocol

- DISCORD: https: // discord.gg/tWdtmzXS

- WHITEPAPER: https://app.gitbook.com/@rabbitfinance/s/homepage/

- CONTRACT: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

- AUDIT: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report