BTCCREDIT - Next-generation decentralized banking ecosystem

About BTCCREDIT

Blockchain makes history by transferring power from entities centered in the hands of consumers. This has empowered people to manage their own assets without interference from banks, brokers, or institutional monitors. This is a necessity that is welcomed because people take too much risk today by letting their crypto assets be controlled by a central entity. They do not realize that they are not, but the Wallet, Exchange, & Lending Platform that controls their assets. Therefore, they have given up control of their identity, privacy and money because they believe that they have no choice. But no more. We aim to be the access point that gives these people choices.

BtcCredit is a complete decentralized wallet that gives you full control of your Blockchain assets to Hold, Exchange, Lend, Borrow, Invest and Bets. This document outlines the Decentralized Next Generation Banking Ecosystem design which is powered by decentralized multi-currency wallets, decentralized p2p loans, and decentralized p2p exchange capabilities.

To date, the cryptocurrency has penetrated into many areas of life. Therefore, the question arises of creating technologies that will bring it closer to ordinary people. The blockchain technology, in modern times, plays an important role in building decentralized financial systems. It allows ordinary people to manage their own assets without the intervention of financial organizations such as banks, funds, brokers, etc. People have been expecting such an opportunity for a long time, as they risk so many people allowing financial institutions to keep their financial assets.

BTCCREDIT is a decentralized banking ecosystem, on the principle of all in one, which allows the user to get full control over his blockchain asset for storing, lending, exchanging, borrowing, investing.

BTCCREDIT is a decentralized banking ecosystem, on the principle of all in one, which allows the user to get full control over his blockchain asset for storing, lending, exchanging, borrowing, investing.

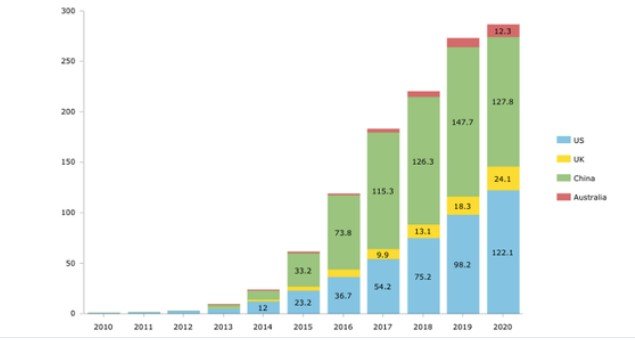

Recently, there has been a steady increase in global market lending. According to the agency Morgan Stanley, its growth could reach $ 290 billion by 2020. One of the features of modern lending is the inequality of the interest rate depending on the location of the borrower. For example, in the high liquidity market in Europe, interest rates range from 0.5–5%, in Russia, 13–15%, in India, 12%, in Brazil, 32%. This suggests that there is an inequality in access to the credit market throughout the world.

BTCCREDIT strives to balance this disparity. The company believes that with the advent of cryptocurrency and blockchain, the user can become the owner of their financial cryptoactive assets. The user himself decides who to borrow his money from whom to borrow, at what interest rate and for what time and other subtleties. So let's take a quick look at how it will work. As a creditor, the user must log in and replenish his system wallet with USDT tokens. After that, the system creates a credit profile of the lender, necessary for the formation of the parameters of the loan. This profile becomes part of the entire ecosystem credit market. As a borrower, the user also logs in with his Bitcoin wallet. Bitcoin funds in the wallet is the key to a future loan. Which requirements are also part of the ecosystem's credit market. Internal logistics and artificial intelligence offer depending on the requirements of automatically existing lenders and borrowers. In addition, the borrower or lender can manually select from a list of offers. After the loan is selected and both parties confirm their agreement, a deal and launch of a smart contract in the Ethereum network will occur. At this time, the amount required by the borrower of the USDT will be credited and the loan repayment schedule will be drawn up.

Consider the terms of loan repayment. Upon completion of the contract or in case of early repayment, the borrower must submit an application. Regular payments look like the administrator regularly pays the lender, and the borrower regularly pays the administrator. If for any reason the borrower missed the payment date, he will receive a 3-day deferment. If he pays during these three days, then no penalty will be charged. Otherwise, a penalty for a specific installment plan is imposed. Well, if the borrower is not able to pay the last 3 payments, then there is a fixation on the blockchain, the borrower is considered insolvent and withdrawal from his collateral. If the borrower wants to close the contract ahead of time, then he can only do so by paying 5% if he has paid at least three consecutive payments.

Another important feature of the BTCCREDIT platform is p2p crypto Exchange. This is a trading platform that provides users with an ecosystem where they can directly exchange cryptocurrencies with each other using p2p technology. In this case, no third party will participate in any type of exchange. Trading here is very simple. The seller logs in, transfers funds to his wallet and publishes a sell order. The buyer checks the range of available sell orders, fits in with the seller. The buyer and the seller agree on the best price and after that a deal is made.

For the successful functioning of the ecosystem and for the convenience of users, the team created the own BTCC token on the platform. Total tokens released 100 million pieces. Of these, 40 million BTCC will be sold at the preliminary stages of the sale. The remaining 40 million BTCC tokens in the next stages of the sale. 20 million Tokin are given to the team, the community, consultants, key employees.

For the successful functioning of the ecosystem and for the convenience of users, the team created the own BTCC token on the platform. Total tokens released 100 million pieces. Of these, 40 million BTCC will be sold at the preliminary stages of the sale. The remaining 40 million BTCC tokens in the next stages of the sale. 20 million Tokin are given to the team, the community, consultants, key employees.

Roadmap

Q4 2018

Launch P2P crypto system lending.

Start of the way with borrowing-crediting, peer-to-peer crypto loans, launching the system.

Smart contract for Ethereum

LDT token contract, BTCC token contract.

Q1 2019

Launch of the USDT lending system.

Users can borrow USDT which relies on LDT tokens and a smart contract.

Developing a mobile application.

Developing a mobile phone compatible credit platform.

Acquisition of licenses

Acquisition of a crypto-wallet and a credit license

Launching a crypto wallet

Launching a crypto wallet.

2 quarter 2019

BTCC in the list of tokens in our credit system.

Users can now lend using BTCC tokens and use BTCC as collateral.

Launch of p2p exchange

Peer Cryptocurrency of the starting exchange platform.

Q3 2019

Launch Plan.

Breakdown of the start-up plan for investors who will receive a percentage benefit if they keep BTCC / BTC tokens on the platform.

Altkotny for credit and compensation.

Now users can lend with altcoins and it will be possible to use altcoins as collateral.

4Q2019

Peer-to-Peer crowdfunding platform.

In conclusion, I would like to say that such a project has every chance of success in a crypto-community and bring profit to its investors in the near future.

Q4 2018

Launch P2P crypto system lending.

Start of the way with borrowing-crediting, peer-to-peer crypto loans, launching the system.

Smart contract for Ethereum

LDT token contract, BTCC token contract.

Q1 2019

Launch of the USDT lending system.

Users can borrow USDT which relies on LDT tokens and a smart contract.

Developing a mobile application.

Developing a mobile phone compatible credit platform.

Acquisition of licenses

Acquisition of a crypto-wallet and a credit license

Launching a crypto wallet

Launching a crypto wallet.

2 quarter 2019

BTCC in the list of tokens in our credit system.

Users can now lend using BTCC tokens and use BTCC as collateral.

Launch of p2p exchange

Peer Cryptocurrency of the starting exchange platform.

Q3 2019

Launch Plan.

Breakdown of the start-up plan for investors who will receive a percentage benefit if they keep BTCC / BTC tokens on the platform.

Altkotny for credit and compensation.

Now users can lend with altcoins and it will be possible to use altcoins as collateral.

4Q2019

Peer-to-Peer crowdfunding platform.

In conclusion, I would like to say that such a project has every chance of success in a crypto-community and bring profit to its investors in the near future.

Website: http://btccredit.io/

🔗 White Paper: http://btccredit.io/pdf/btccredit_whitepaper.pdf

Twitter: https://twitter.com/btc_credit

🔗 Facebook: https: //www.facebook .com / BTCCredit-1017662868433011 /

🔗 Telegram: https://t.me/btccredit1

🔗 Medium: https://medium.com/@info_60688

YouTube: https://www.youtube.com/channel/UCLE1iXyR2aTEgx4x6mQ0Lig/featured ? view_as = subscriber

🔗 Instagram: https://www.instagram.com/btccredit

🔗 White Paper: http://btccredit.io/pdf/btccredit_whitepaper.pdf

Twitter: https://twitter.com/btc_credit

🔗 Facebook: https: //www.facebook .com / BTCCredit-1017662868433011 /

🔗 Telegram: https://t.me/btccredit1

🔗 Medium: https://medium.com/@info_60688

YouTube: https://www.youtube.com/channel/UCLE1iXyR2aTEgx4x6mQ0Lig/featured ? view_as = subscriber

🔗 Instagram: https://www.instagram.com/btccredit

AUTHOR: The clay

My Bitcointalk Profile Link: https://bitcointalk.org/index.php?action=profile;u=1814446

Tidak ada komentar:

Posting Komentar